Bloodsuckers preying on aspiring OFWs make a killing on placement fees, illegal loans

MANILA, Philippines—Joanna Gaon, 35, has already taken on the job of a domestic worker in several countries, so when she took a chance to find work in Hong Kong, she knew that she had to pay thousands of pesos in placement fee once again.

She told INQUIRER.net via FB Messenger how she was told that there was no need to pay a placement fee, or the amount charged by an agent or a recruitment agency to workers seeking employment overseas.

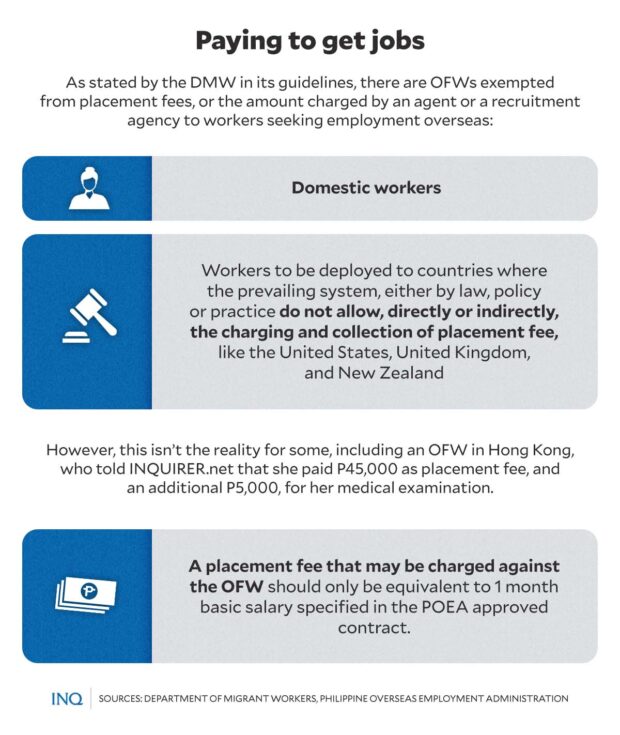

The Department of Migrant Workers (DMW) stated that domestic workers and workers, who are to be deployed to countries where placement fees are banned, are exempted from paying the charge.

However, while this could be the case for a few, Gaon said like most Filipinos seeking employment overseas, she paid an overwhelming P45,000 as placement fee and an additional P5,000, which was spent on her medical examination.

As stated in the guidelines issued by the DMW, a placement fee that may be charged against an overseas Filipino worker (OFW) should only be equivalent to one month’s basic salary specified in the POEA-approved contract.

The POEA, or the Philippine Overseas Employment Administration, is a government agency responsible for monitoring and regulating private recruitment agencies all over the Philippines.

This year, some lawmakers already expressed support to a move to stop the collection of placement fees, with Sen. Aquilino Pimentel III saying that “if foreign employers want staff, workers, and employees, then they should shoulder these placement fees.”

GRAPHIC Ed Lustan

But while this was being debated upon, some Filipinos seeking employment overseas were already being “cheated” by recruitment agencies and loan companies in “schemes that combine labor exploitation and predatory lending,” according to a report by the International Consortium of Investigative Journalists (ICIJ), a Nobel Peace Prize nominee for its campaign against dark money, or illicit funds and their laundering.

The ICIJ published last month the report, “Philippine lenders and labor agents fleece workers seeking overseas jobs, interviews and confidential documents show.”

Exploited, cheated

According to the report, which was written by Katie McQue based on interviews with workers and thousands of pages of confidential complaints, “these companies play on workers’ hopes for better lives and their families.”

“[They are] pressuring them into paying illegal recruiting fees and taking out loans with interest rates often exceeding 130 percent,” the report read, stressing that Filipinos’ financial needs and uncertain immigration status leave them vulnerable to abuses.

GRAPHIC Ed Lustan

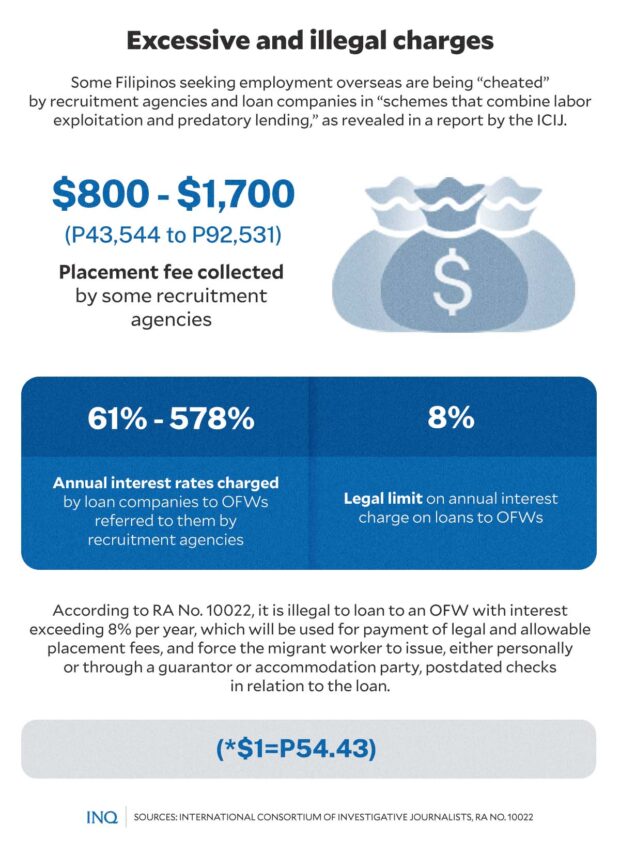

These recruiting companies tell individuals seeking employment overseas that they cannot get coveted positions as domestic workers in Hong Kong or Taiwan unless they pay fees ranging between $800 to $1,700, or P43,544 to P92,531.

Too excessive, the collection of placement fees, which is already illegal, based on guidelines issued by the DMW, “represent huge sums for workers from impoverished backgrounds.”

Because most jobseekers do not have enough money to settle the placement fee, recruiting companies “steer workers to lenders that advance them money to cover the hefty fees.”

“The interviews and documents reveal that these lenders promise low interest rates but the actual interest charges are much higher — with annual interest rates ranging between 61 percent and 578 percent,” the ICIJ report said.

As stated in Republic Act No. 10022, it is illegal to collect interest on loans, supposedly for placement fees, to OFWs exceeding 8 percent per year.

Likewise, it is also illegal to make the migrant worker issue, either personally or through a guarantor or accommodation party, postdated checks for the loan.

According to ICIJ, which looked at confidential complaints prepared by Hong Kong-based NGO Migrasia, the recruiters and lenders “pull off the schemes […] by rushing through a smoke-and-mirrors process.”

This, the ICIJ report said, “hides key details about their employment and loan contracts.”

“[…] some lenders blackmail borrowers by coercing them into signing over blank checks — and then threatening to ‘bounce’ the checks and file criminal charges against them if they complain to government authorities or don’t keep up with their payments,” said the ICIJ report.

Left with no choice

Gaon, who flew to Hong Kong in 2019, said she was referred to a lending company, too, since she had not enough money to pay the placement fee being demanded by the recruiter.

“P45,000 is a huge amount and back then, should I proceed with my employment overseas, the compensation was only set at over P30,000. I had to pay thousands more, too, for the medical examination,” she said.

GRAPHIC Ed Lustan

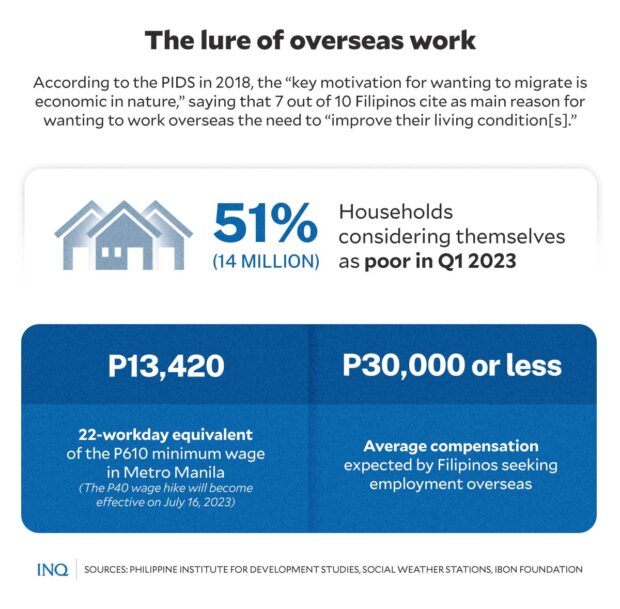

According to the latest Social Weather Stations (SWS) data, 51 percent, or 14 million households, considered themselves as poor in the first quarter of 2023, higher than the 12.9 million in the last quarter of 2022, although the rate was the same.

Gaon said when all her documents, especially the requirements for her flight, were already prepared, and she still did not have the money to settle the recruitment fee, she was told that a company can lend her some.

She had no choice, so with a 1.8 percent interest rate agreement she decided to give in.

However, she was not sure, though, if it was really only less than two percent: “I was in doubt, and incidentally, I lacked one requirement, so my application for loan was disapproved.” She borrowed from her relatives instead.

Despite not being charged high loan interest rates, she stressed that a huge recruitment fee is really an unbearable burden for Filipinos like her, who only want to provide better lives for family left in the Philippines.

Some of the complaints had already been filed, however, “little progress has been made” in combating the schemes that exploit Filipinos. One of the succeeding complaints alleged that a government office merely acknowledged receipt.

As Migrasia said in a statement provided to ICIJ, the problem has persisted.

“We hope that authorities in the Philippines and Hong Kong start to take these issues more seriously and listen to community leaders and experts so that they can permanently eliminate these illegal fees and debts from arising,” the group said in its letter to ICIJ.

At least 12 licensed loan companies in the Philippines were named in the complaints.

Leaving PH

According to a latest SWS data, which was the result of a survey conducted in March, seven percent of Filipino households reported having a member currently working overseas.

The percentage, however, could increase, since there are Filipinos—four percent—currently looking for employment outside the Philippines, with these countries topping the list of preferred OFW destinations:

- Japan: 14 percent

- Canada: 13 percent

- Saudi Arabia: 11 percent

- South Korea: 11 percent

- Australia: 11 percent

- USA: 9 percent

A study conducted by the Philippine Institute for Development Studies (PIDS) in 2018 revealed that most Filipinos who want to work overseas were looking for an average compensation of at least P30,000 a month.

Recently, the regional wage board in Metro Manila has approved a P40 wage hike, increasing the minimum wage in the region to P610 from P570. The 22-workday equivalent of the P610 minimum wage is only P13,240.

PIDS Supervising Research Specialist Aubrey Tabuga said in the study, “A Probe into the Filipino Migration Culture: What Is There to Learn for Policy Intervention?” said “the key motivation for wanting to migrate is economic in nature.”

“Seven out of the 10 aspirants cited their need to improve their living condition as the main reason for wanting to emigrate,” she said, pointing out that these economic reasons are based on the underlying dissatisfaction of workers with their incomes.

Taguba said “if people do have a choice, they would rather stay and be with their families and loved ones,” stressing that “family-related reason is most commonly cited factor that could make would-be migrants reconsider their migration decisions.”

However, millions of Filipino households do not have any choice, especially since 50.2 percent of respondents in the SWS survey expressed discontent with their incomes. “Given more secure local job opportunities, a non-negligible proportion would opt to stay,” Taguba said.

‘Do away with fees’

As stressed by Sen. Joel Villanueva, the government has to ensure the proper implementation of the law and arrest those who extort illegal fees from Filipinos seeking employment overseas.

According to data from the recruitment agency Rensol, nine out of 2,000 companies already oppose the charging of placement fees “as an ethical practice to serve Filipinos.”

“Even if the no-placement-fee system may cause indifference to some foreign clients because of the inevitable higher cost, these agencies brave to pursue ethical recruitment with integrity in mind assuring that this is the way of fulfilling everyone’s goal for success,” the company said.

Here are some of the reasons “zero placement fee” is the way to go, it said:

- Workers should be selected and screened based on their technical skills and qualifications rather than their ability to pay placement fees to get endorsed for a job.

- The “no placement fee” tag on recruitment advertisements is an effective tool for talent attraction. Most qualified and experienced candidates are wise enough not to patronize agencies which will just make money out of them.

- A worker not charged with a placement fee is in a better position to contribute effectively to the job he signed up for because he no longer needs to worry about loans to pay.

- Exorbitant fees and fraudulent recruitment by means of overcharging was given the highest penalty under the law.

- The reputation and integrity of an employer is measured by how committed they are to their public service to provide opportunities that the less privileged, yet globally-competitive ones could afford.

Any person found guilty of acts prohibited by RA No. 10022 shall suffer the penalty of imprisonment of not less than six years and one day but not more than 12 years and a fine of not less than P500,000 nor more than P1 million.